Step 1: Buy Your First Home with a USDA Loan

USDA loans are designed to help buyers purchase homes in rural or suburban areas with 0% down payment. By finding a USDA-eligible home and negotiating 6% in seller concessions, a buyer can cover all closing costs and even buy down their interest rate.

The result? You can get into your first home with less than $1,000 out of pocket.

By keeping the remaining $4,000 in reserves, you also meet an important compensating factor lenders look for—proving you can handle unexpected expenses and future mortgage payments.

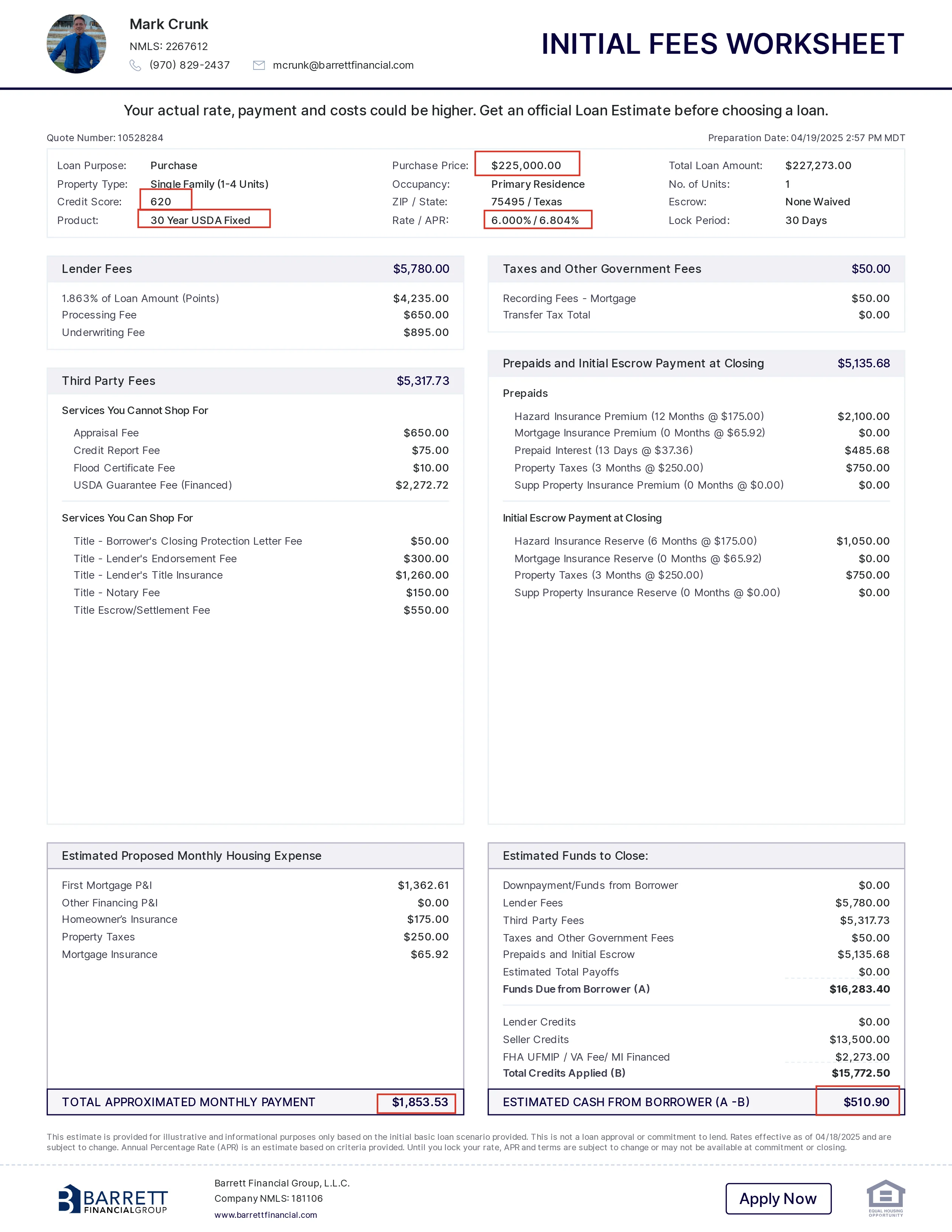

Let's take a quick look at a hypothetical scenario based upon interest rates as of 4/17/25, a credit score of 620, and the ability to qualify for a USDA mortgage:

A home outside of Dallas, Texas is listed in eligible USDA area for $225,000. The home just had a $10,000 price reduction and is now currently listed for $215,000. An offer of $225,000 and asking for 6% in seller concessions to help pay for closing costs and buy down the interest rate would be made. If successful the total out of pocket expense is just over $500 and the interest rate would be 6%/6.804% APR and a monthly payment of about $1,855. Assume that the home appreciates in value at 1% annually ($231,820), and the balance of the mortgage is $217,510. That would be $14,310 in equity!

Step 2: Live in the Home for 2 Years and Prepare for the Next Move

During those two years, you’re not just paying rent anymore—you’re:

Step 3: Rent Out Your First Home and Buy the Next

Once the two years are up, you convert your first home into a rental property. Then you purchase your next primary residence using a 5% down conventional loan. No need for it to be in a USDA area.

Every two years, you do it again:

In 10 years, you could own 5 to 6 properties, with 4 to 5 producing rental income.

The Real Wealth Starts Here

This strategy doesn’t just give you rental properties. It gives you:

1. Equity Growth Each mortgage payment reduces your balance. Renters help pay down your loan.

2. Appreciation Even a 1.5% annual appreciation adds up over 10-12 years.

3. Passive Income Rents go up. Mortgage payments stay mostly the same. Your cash flow grows.

4. Tax Benefits Depreciation, mortgage interest, repairs, and expenses are all tax-deductible.

5. Generational Wealth You’re not just investing for yourself. You’re building assets you can pass down.

Final Thoughts

You don’t need a massive down payment. You don’t need to be wealthy. You just need $5,000, a plan, and the discipline to follow through.

If you're ready to stop renting, start investing, and take control of your financial future—reach out today. I’ll help you map out your first step.

Let’s build something that lasts.

970-829-2437 | Schedule a Call | See If You Qualify. Even if you don't qualify yet, let's get a plan together to get you mortgage ready!

Whether you're buying your first home or your dream home, we have a mortgage solution for you. Get your custom rate quote today.

We're committed to helping you refinance with the lowest rates and fees in the industry today. Getting started is quick and easy.

Our secure application is a few quick questions that takes about 7-10 minutes to complete and is required for a “Pre-Approval”. Get started today!

Mark Crunk | NMLS #2267612 | Barrett Financial Group, L.L.C. | NMLS #181106 | 275 E Rivulon Blvd, Suite 200, Gilbert, AZ

85297 | AK AK181106 | CO | MO | NC B-203722 | Equal Housing Opportunity | This is not a commitment to lend. All loans are

subject to credit approval. | nmlsconsumeraccess.org/EntityDetails.aspx/COMPANY/181106