Let’s say you’re paying $1,850/month in rent, which is fairly typical in many areas today.

In just three years, you’ll have spent $66,600 in rent.

That’s money you’ll never get back. It doesn’t build wealth. It doesn’t grow equity. It just... disappears. And if rent goes up (as it likely will), the number gets even higher.

Now imagine instead that you had been able to buy a home — maybe using a low or no down payment loan like USDA or FHA. What might your situation look like in three years?

Purchase a home that is in a USDA eligible area with a USDA 0% down payment 30 year fixed loan. Find a home that has had a price reduction and use that to your advantage by increasing the purchase price and asking for seller concessions (6% of the sales price is preferred). If negotiated successfully, we would look at this hypothetical scenario:

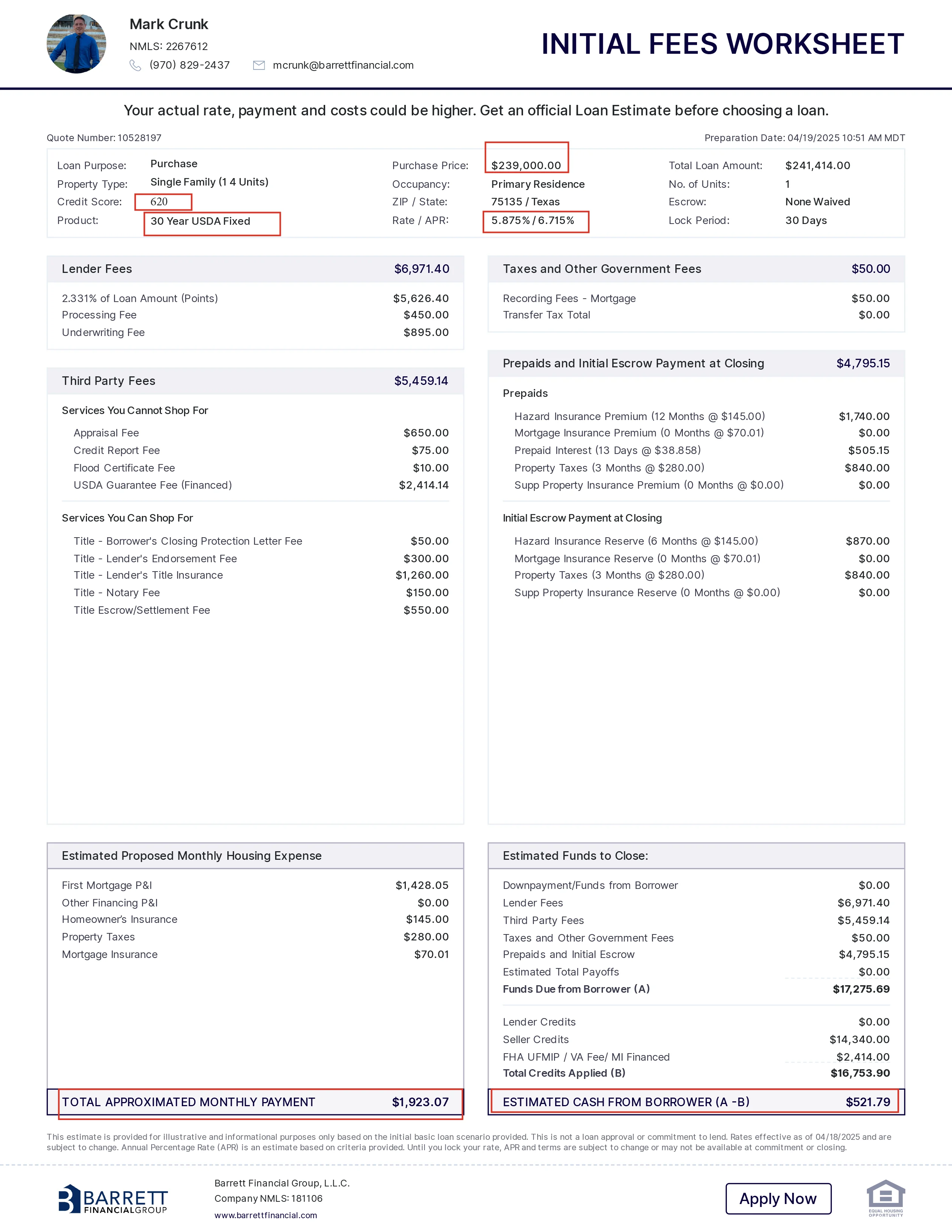

Home listed at $229,000 that had a price reduction of $10,000. Offer to seller to purchase at $239,000 and ask for 6% in seller concessions. With those concessions pay for all or most closing costs and pay points to buy down the interest rate. With the example in this hypothetical scenario with interest rates as of 4/17/25 and a credit score of 620 and the ability to qualify for a USDA mortgage, the total out of pocket expense would be less than $1,000 and a bought down interest rate would be 5.875%/6.715% APR and depending on taxes and insurance, the total monthly payments would be about $1,925.00, which would be more than the rent payment of $1,850.

After three years the total monthly payments made would be about $69,300 which is about $2700 more than the total rent payments would be. Average that over 3 years and you would be paying about $2.50 per day more in order to own the home. After three years, the approximate balance of the mortgage on the home would be $230,870 and if the home value appreciates at 1%, the approximate value of the home would be $246,230 which would give you about $15,360 in equity.

Owning a home isn’t just a financial move — it’s an emotional one.

That’s okay. Truly.

But don’t stop moving toward the goal. If your credit needs work, let’s start there. If saving is hard, we can talk about a plan. If you’re unsure about job stability, time might be your best friend.

You don’t need to be perfect to buy a home. You just need a path — and someone to help guide you along the way.

Whether it's three months or three years from now, let’s keep the conversation going. You might be surprised at how many options you have — even with a low credit score or limited cash.

The earlier you start planning, the sooner you’ll be holding keys to your future.

Ready to explore what homeownership could look like for you — even if it’s not today?

Let’s talk. No pressure, no obligation — just answers.

Whether you're buying your first home or your dream home, we have a mortgage solution for you. Get your custom rate quote today.

We're committed to helping you refinance with the lowest rates and fees in the industry today. Getting started is quick and easy.

Our secure application is a few quick questions that takes about 7-10 minutes to complete and is required for a “Pre-Approval”. Get started today!

Mark Crunk | NMLS #2267612 | Barrett Financial Group, L.L.C. | NMLS #181106 | 275 E Rivulon Blvd, Suite 200, Gilbert, AZ

85297 | AK AK181106 | CO | MO | NC B-203722 | Equal Housing Opportunity | This is not a commitment to lend. All loans are

subject to credit approval. | nmlsconsumeraccess.org/EntityDetails.aspx/COMPANY/181106